Dec 10, 2025

4 min read

How to Get a Loan for a Seasonal Business in 5 Steps

Seasonal businesses face financial challenges that year-round operations often don’t. Whether...

Read story

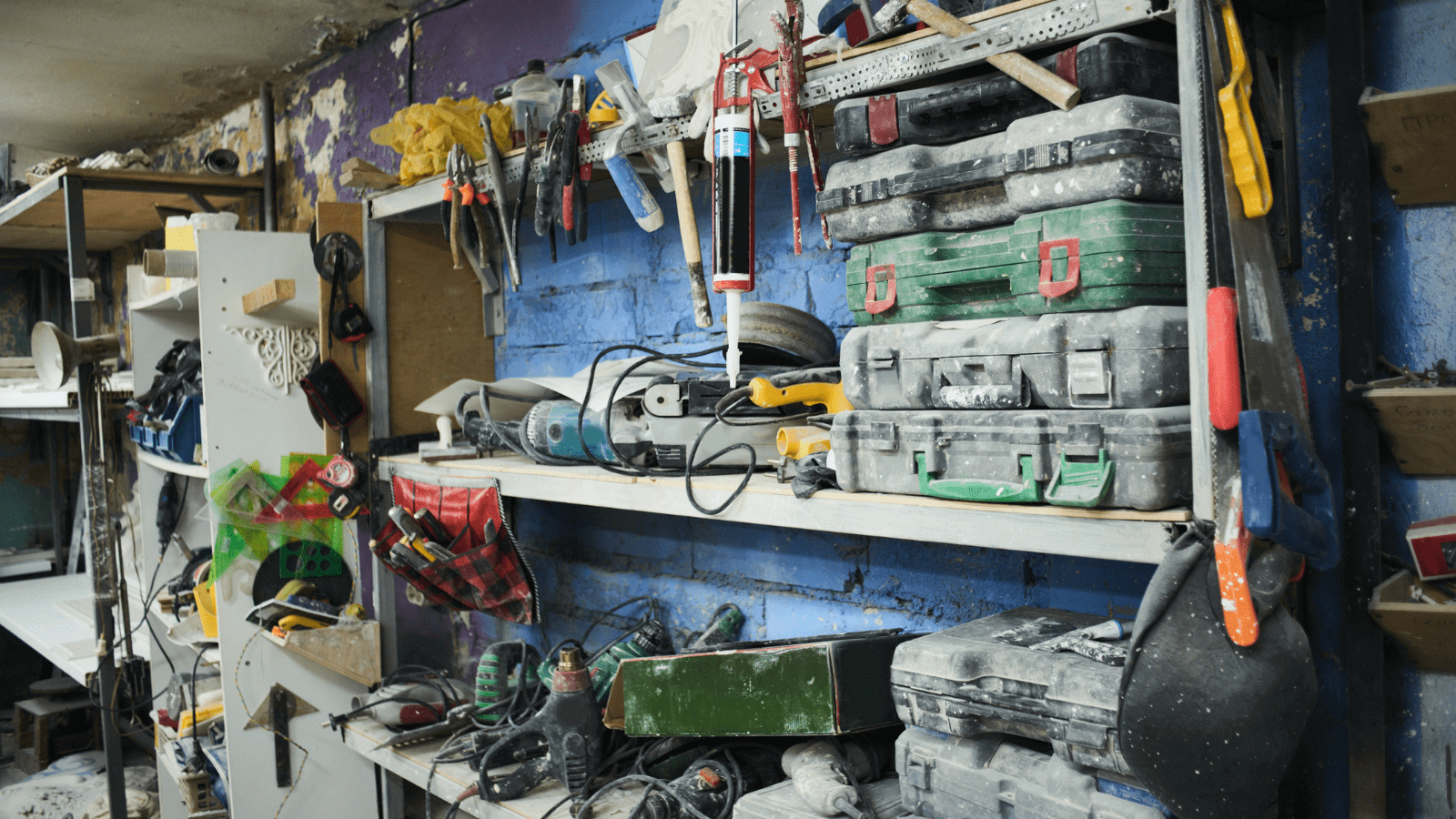

Navigating the seasonality of the construction business is essential for industry professionals seeking to maintain consistent operations and maximize profitability throughout the year. Seasonal fluctuations—shaped by factors like weather conditions, economic cycles, and regulatory changes—can significantly impact demand, project timelines, and overall productivity. By recognizing and adapting to these seasonal patterns, construction businesses can strategically allocate resources, manage workforce demands, and optimize project scheduling to stay competitive. This article breaks down practical strategies to help businesses overcome cyclical challenges, ensure financial stability, and seize opportunities during periods of peak activity.

Seasonal revenue analysis is essential for construction business owners who want to anticipate income fluctuations and align their financial expectations with the industry’s seasonal nature. This proactive approach helps businesses manage cash flow and allocate resources effectively throughout the year.

A thorough analysis starts by examining at least three years of historical financial data to identify trends and variations across different seasons. By reviewing past revenue reports, construction companies can pinpoint peak periods when projects are most profitable and identify slower months when income may decline. For example, a construction firm operating in a northern climate might see reduced demand during the winter months but an uptick in summer and fall.

Considering external factors like weather, local economic conditions, and regulatory changes is equally vital. For instance, while winter may slow projects in colder regions, summer often brings increased demand for construction services. Adjusting marketing efforts and resource allocation to align with these trends can help offset potential revenue dips.

Businesses should also look for growth opportunities during slower seasons by offering services less affected by weather, such as indoor renovations or repair work. Diversifying service offerings can create a stable cash flow and reduce the financial impact of seasonal lulls.

By applying these insights, construction companies can plan more effectively, maintain financial stability, and be better prepared for both peak and off-peak seasons.

Flexible workforce management is a key strategy for navigating construction seasonality and maintaining productivity year-round. By employing a mix of permanent and temporary workers, businesses can scale their workforce according to project demands, avoiding the financial strain of a large full-time staff during off-peak periods.

Training programs are essential for ensuring that both permanent and temporary employees are equipped to handle various tasks, enhancing efficiency and work quality. Cross-training employees to perform multiple roles allows businesses to allocate resources effectively during busy periods and reduces the risk of project delays. For example, a construction firm that cross-trains its workers in both framing and finishing tasks can adapt more quickly when project timelines shift.

Leveraging workforce management technology, such as scheduling software and project management tools, provides real-time insights into employee availability and project needs. This technological approach helps streamline scheduling, track progress, and make informed staffing decisions. Tools like Procore or Buildertrend, for instance, allow construction managers to coordinate shifts and project timelines efficiently.

Effective communication is also vital. Focus on being a good leader by keeping team members informed about project timelines and any scheduling changes. This fosters transparency and promotes a collaborative work environment, ensuring that workers remain committed and engaged.

By maintaining a flexible workforce and integrating technology-driven solutions, construction businesses can better adapt to seasonal demand fluctuations, optimize productivity, and maintain profitability throughout the year.

Expanding service offerings is a strategic way to mitigate the impact of seasonality on construction businesses. By broadening their range of services, companies can maintain steady operations and revenue, even during periods when primary construction activities slow due to weather or reduced demand.

Consider adding complementary services that align with the company’s core strengths. For instance, during off-peak seasons, offering maintenance, repair, and renovation services can generate consistent income as these activities often experience demand regardless of weather conditions. Some construction businesses have successfully filled revenue gaps by providing landscaping, snow removal, or interior renovation services, ensuring their teams remain active year-round.

Exploring new market segments can further strengthen a company’s position. Services such as energy-efficient upgrades or smart home installations cater to the growing demand for sustainable and innovative living solutions. This approach not only attracts environmentally conscious clients but also opens the door to government incentives for energy-efficient projects.

Adapting to industry trends, such as incorporating green building practices or partnering with specialized subcontractors for niche projects, can further expand a construction business’s market reach. Diversifying service offerings can build resilience, reduce dependency on weather-affected projects, and keep revenue streams stable.

By thoughtfully adding related services, construction companies can position themselves as adaptable and forward-thinking leaders in the industry.

Strategic cash flow planning is crucial for construction businesses to manage the impact of seasonality effectively. By understanding and forecasting cash flow fluctuations, businesses can maintain financial stability and avoid shortages during slower periods.

Accurate cash flow forecasting begins with analyzing historical data to identify revenue and expense patterns over several years. This allows businesses to anticipate cash flow needs and plan accordingly. For instance, a construction company that identifies slower cash flow in winter months can proactively plan to reduce costs and allocate funds for essential expenses during that time.

Creating a cash reserve fund is another essential step for financial resilience. By setting aside a percentage of profits earned during busy periods, businesses build a financial cushion that can be used during off-peak seasons. This approach helps maintain operations without relying on external financing during leaner times.

Efficient management of accounts receivable and payable further supports cash flow. Negotiating favorable payment terms with clients and suppliers can ensure steady cash flow. For example, shortening client payment collection times while extending bill payments can bridge gaps between incoming and outgoing funds, reducing the risk of cash shortages.

Regular budget reviews and adjustments are also vital as market conditions change. Reassessing financial plans quarterly helps businesses avoid overextending themselves during peak seasons and ensures readiness during slower periods. Implementing budget controls allows for identifying unnecessary expenditures and reallocating funds to critical areas.

By adopting strategic cash flow management practices, construction businesses can navigate the financial challenges of seasonality, minimize disruptions, and sustain their operations year-round.

Off-peak project scheduling is an effective strategy for maintaining operational efficiency and steady workflow throughout the year. By aligning project timelines with periods of lower demand, construction businesses can mitigate seasonal slowdowns and enhance productivity.

Scheduling projects that are less affected by weather conditions during off-peak seasons, such as indoor renovations or maintenance work, ensures that the workforce stays active and revenue streams remain steady. For example, a construction company specializing in commercial projects might schedule interior office renovations during winter months when outdoor construction is less feasible. This approach not only keeps employees engaged but also helps generate income when weather-dependent projects are on hold.

Off-peak scheduling also offers financial advantages. Companies can often benefit from lower material costs and reduced competition for resources during these times. For instance, ordering materials during slower seasons may result in discounted prices or faster delivery times due to decreased demand across the industry.

To implement effective off-peak project scheduling, businesses should start by analyzing market trends to understand cyclical demand patterns in their specific region. Engaging with clients early and promoting the benefits of scheduling projects during off-peak times—such as cost savings and faster project completion—can help secure contracts that keep the business running year-round.

Optimizing resource allocation by planning supply chain needs and scheduling routine maintenance during slower periods also contributes to operational efficiency. Regularly monitoring and adjusting schedules in response to market changes or unexpected disruptions ensures flexibility and minimizes delays.

By adopting off-peak project scheduling, construction companies can stabilize their operations, maintain profitability, and position themselves as adaptable leaders in the industry.

Navigating the financial demands of the construction industry can be challenging, especially during seasonal fluctuations or when unexpected expenses arise. SBG Funding offers tailored funding solutions that help construction businesses manage cash flow, invest in equipment, and maintain operational efficiency without the delays often experienced with traditional lenders.

SBG Funding makes it easy for construction companies to secure financing with a simplified process designed for quick access to funds. This ensures that businesses can focus on their projects rather than being burdened by complicated paperwork and long approval times.

To streamline the application process, SBG Funding typically requires:

SBG Funding works with construction businesses that meet key criteria, including:

By offering a transparent and efficient funding process, SBG Funding helps construction companies manage cash flow, bridge gaps during seasonal slowdowns, purchase equipment, and seize new business opportunities with ease. This allows construction business owners to stay focused on growth and project delivery without the extended wait associated with traditional financing.

Dec 10, 2025

4 min read

Seasonal businesses face financial challenges that year-round operations often don’t. Whether...

Read story

Dec 08, 2025

5 min read

Running an e‑commerce business may not come with the overhead of...

Read story

Nov 19, 2025

4 min read

Getting denied for a business loan because of your credit score...

Read story

A funding specialist will get back to you soon.

If you can’t hang on then give us a call at (844) 284-2725 or complete your working capital application here.