Oct 21, 2024

5 min read

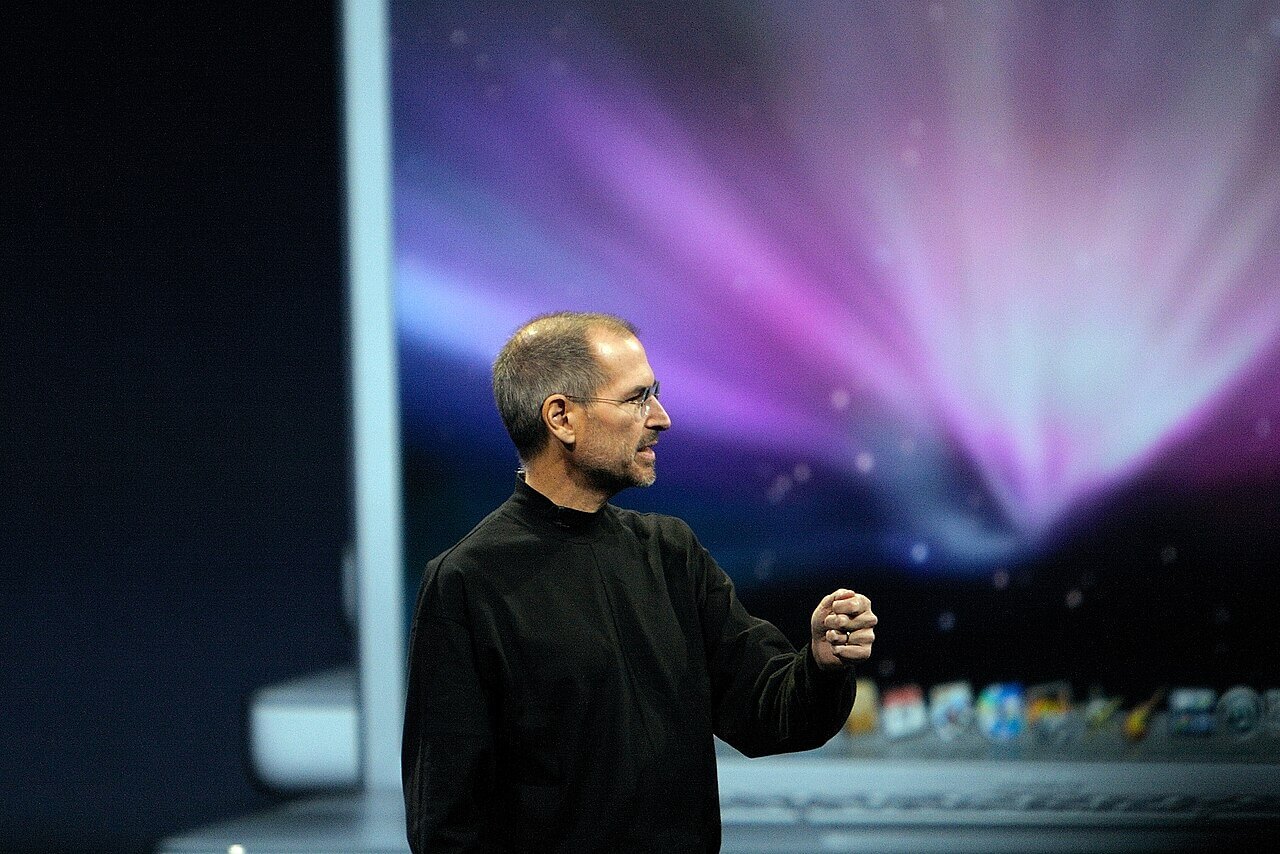

11 Steve Jobs Quotes to Guide Your Business Journey

Steve Jobs was known for his ability to think differently, take...

Read story

The U.S. economy is set to outpace other advanced nations, with the International Monetary Fund (IMF) projecting a 2.5% growth rate for 2024. This performance, the fastest among G7 economies, reflects a combination of rising nonresidential investment, higher productivity, and steady wage growth. Unlike other regions grappling with economic challenges, the U.S. has benefited from energy independence, shielding businesses from disruptions and volatile costs.

Small businesses are particularly positioned to feel the ripple effects of this growth. Rising consumer demand, combined with greater business investment, can create new opportunities for those looking to expand or strengthen operations. Understanding how broader economic trends impact financing and operations can help businesses plan ahead—whether that means investing in infrastructure, upgrading technology, or building cash reserves to weather future changes.

The IMF’s 2024 forecast shows that the U.S. economy is positioned to lead global growth, thanks to a combination of strategic investments, productivity increases, and energy independence. These trends reflect a broader shift in the economic landscape, underscoring the importance of staying agile and well-prepared in an evolving market. Below are the key areas where these shifts are most evident and their implications for businesses.

The IMF projects U.S. gross fixed capital formation—covering investments in equipment, infrastructure, and technology—will grow by 4.5% in 2024. This increase outpaces many other advanced economies, such as Germany, where capital investment is expected to shrink by 2.7%. This surge in U.S. investment is driven by substantial federal support, including initiatives like the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law, which collectively committed over $1.57 trillion over the next decade.

The OECD’s 2024 Economic Outlook highlights that these investments are designed to modernize infrastructure and support green energy transitions, positioning the U.S. for long-term competitiveness. Investments in software, digital technologies, and intellectual property also play a critical role, helping businesses streamline operations and improve efficiency. However, the OECD report warns that challenges, such as labor shortages in the construction sector, may delay some infrastructure projects if workforce gaps are not addressed.

These trends indicate that U.S. businesses investing in new technologies and infrastructure now will be well-positioned to stay ahead of global competitors as the economy grows.

Productivity—measured as output per hour worked—has been steadily rising in the U.S., allowing companies to increase real wages without sacrificing margins. Higher wages enhance consumer purchasing power, fueling stronger demand across industries. The IMF report emphasizes that real wage growth is a key factor driving consumer spending, which is vital for businesses targeting domestic markets.

Recent findings from McKinsey highlight that investments in digital technologies and intellectual property have been pivotal in sustaining productivity growth. Sectors such as information services and professional services—those that adopted advanced technologies—contributed over 70% of the cumulative productivity growth since 2019. Furthermore, the adoption of remote work and automation has helped businesses optimize operations, reducing costs while maintaining performance levels. McKinsey also stresses that ongoing technology adoption will be crucial to sustain this momentum in the coming years.

These trends suggest that businesses investing in digital transformation and operational efficiency will be better positioned to capitalize on rising consumer demand and maintain competitive advantages.

Energy independence has become a cornerstone of the U.S. economy, with domestic energy production significantly reducing reliance on foreign oil. This has shielded businesses from price shocks that have impacted other economies, particularly in Europe, where companies are still paying two to five times more for electricity and natural gas. The stability in energy prices allows U.S. businesses to better manage operating costs and reinvest savings into growth initiatives.

According to Deloitte’s 2024 Renewable Energy Industry Outlook, federal incentives, such as those introduced through the Inflation Reduction Act (IRA), have accelerated investment in renewable infrastructure and energy storage. The report indicates that IRA-fueled renewable energy investments will contribute to a 12% increase in U.S. clean energy capacity by 2025. These initiatives not only enhance energy reliability but also position the U.S. as a leader in clean energy, creating opportunities for industries to build more resilient operations. As renewables play a growing role, companies benefit from predictable energy costs and an expanding green economy, strengthening their ability to compete globally.

Economic momentum offers small businesses a rare chance to build resilience and scale operations. The IMF’s projection of 2.5% GDP growth in 2024 signals a favorable environment for business expansion. Rising real wages, driven by productivity gains, indicate stronger consumer spending—translating to increased demand for goods and services. Businesses that act now can position themselves to benefit from this growth wave.

Another key opportunity lies in accessing financing. During periods of economic strength, lenders are typically more willing to offer favorable loan terms. This makes it an ideal time to pursue funding for upgrading technology, expanding product lines, or hiring skilled employees. Investments made in times of stability tend to pay off as businesses can operate with fewer constraints while preparing for future challenges.

Moreover, stable energy prices provide predictability in operational costs. While businesses in Europe grapple with high energy prices and disruptions, U.S. companies enjoy lower costs, freeing up resources to reinvest in growth. Small businesses can leverage this advantage by focusing on improving efficiency, automating processes, or developing new services that cater to the evolving market demand.

Taking action now also provides a hedge against economic uncertainty. While the economy is currently strong, challenges can arise, and businesses that invest wisely today will be better positioned to navigate future downturns. Planning ahead—whether by building cash reserves or securing financing—can help small businesses thrive in both good times and bad.

As the U.S. economy strengthens, businesses have a unique opportunity to invest in their future with the right financing. SBG Funding offers several tailored solutions designed to support businesses through expansion, upgrades, or operational improvements:

With economic growth on the rise, accessing flexible financing now ensures businesses can seize opportunities before market conditions change. Whether investing in infrastructure, hiring employees, or expanding product lines, SBG Funding offers fast, reliable options that align with your business goals.

Oct 21, 2024

5 min read

Steve Jobs was known for his ability to think differently, take...

Read story

Oct 16, 2024

5 min read

As of October 2024, the IRS is actively working through a...

Read story

Jul 29, 2024

7 min read

Securing a business loan is crucial for entrepreneurs and small business...

Read story

A funding specialist will get back to you soon.

If you can’t hang on then give us a call at (844) 284-2725 or complete your working capital application here.