Jun 24, 2024

5 min read

Business Line of Credit vs. Credit Card: Which Is Best?

Business financing comes in layers, like an upside-down pyramid. On the...

Read story

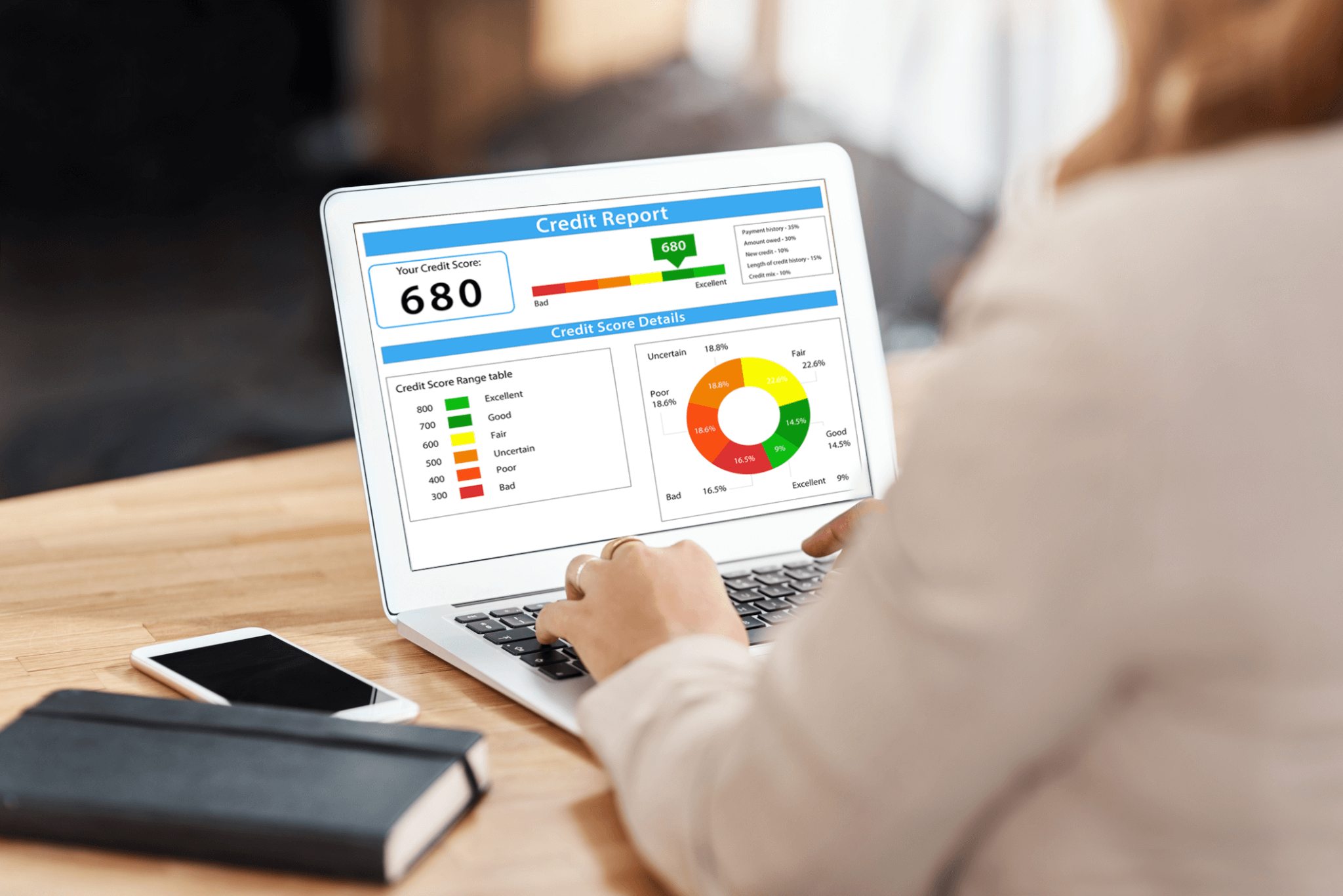

Credit— It affects a great deal of how we operate on a daily basis. For some, the idea of navigating credit comes easy. For others, it can be a mythical creature that always seems out of reach. Credit doesn’t have to be hard to navigate, but it will take diligence on your part.

Let’s break down the two larger areas of credit and make them less daunting to the average person or business.

Many businesses take advantage of using credit to help build and establish their brand in today’s economy. But where and how do you start? Will it affect your personal finances? Let’s take a look.

Businesses use credit to run the day to day operations. Keeping these accounts and credit profiles separate from personal assets is key. Your business runs as its own entity, not an offshoot of your personal life. Showing separate ownership not only helps with establishing credit, but also with taxes.

There are a few steps that need to be followed in establishing credit for your business. The order is important since some things you can’t do before you finish the step before.

Using these tips will allow you to have better pay terms when you use new vendors. There will be less upfront or prepay terms with those vendors as well. Lastly, it will allow you to have lower interest rates and terms on credit cards from banks and lending agencies. Be aware about keeping your payments on time. This is crucial to growing that mythical number.

Now let’s venture over to the personal side of credit. Many times, if you are establishing new credit or rebuilding existing credit, you will need to start with either a secured credit card or loan, have a cosigner or co-borrower, or be an authorized signer on someone else’s credit card or loan. There are credit builder loans available.

You may see the interest rate at a much higher level than conventional loans and cards, but this is because you need to establish a history of trust with these companies. Remember, these are not meant to be kept for long periods of time. Once you’ve made on time payments for a good amount of time (12 consecutive months works well for banks), you are able to apply for traditional products that may have better terms. Keep these pointers in mind;

Sticking close to these simple steps can allow your score to grow faster than you think. Remember, it’s about time and work. You will need both to achieve the credit you desire for your personal life and for your business.

Jun 24, 2024

5 min read

Business financing comes in layers, like an upside-down pyramid. On the...

Read story

Jun 24, 2024

5 min read

Understanding how a business loan works is like tending to your...

Read story

Jun 24, 2024

5 min read

Business acquisitions are strategic investments that allow business owners to consolidate...

Read story

A funding specialist will get back to you soon.

If you can’t hang on then give us a call at (844) 284-2725 or complete your working capital application here.