Mar 05, 2024

5 min read

Speed Up Business Success: Fast Business Loans

Starting and growing a business requires immense working capital reserves, and...

Read story

A company budget is one of the most important tools for managing finances and setting strategic direction. It lays out how much your business expects to earn, what it plans to spend, and where resources should be allocated to support operations and growth.

Without a clear budget, it’s difficult to make confident decisions or measure performance. A solid budgeting process helps you anticipate costs, avoid overspending, and plan for both short-term needs and long-term goals. It also gives your team a framework for accountability and financial discipline.

In this article, we’ll walk through how to prepare a budget for a company step by step. From defining goals to forecasting revenue and monitoring results, each part of the process plays a role in building a stable financial foundation.

Before building a budget, it’s essential to understand what your company is working toward. Your financial plan should reflect your broader business strategy, whether you’re aiming for growth, stability, or cost reduction. Clear goals help guide spending decisions and ensure that resources are allocated where they can have the most impact.

Start by outlining your top priorities for the budgeting period. These might include expanding into a new market, increasing production capacity, launching a new product, or hiring key staff. If you’re already operating at scale, goals could focus on improving margins, streamlining operations, or investing in technology.

Once your objectives are set, use them to shape how you structure the rest of your budget. Departments and teams should understand how their spending supports the company’s direction. Aligning your financial plan with specific outcomes makes it easier to track progress and justify investments along the way.

A budget is only as accurate as the information behind it. Reviewing your company’s historical financial data gives you a baseline for future planning and helps identify trends in revenue, expenses, and cash flow. This step also highlights areas where your past budget may have fallen short or exceeded expectations.

Start by collecting data from your core financial statements:

Look at data from at least the last 12 months, and ideally from multiple years if available. Pay close attention to seasonal fluctuations, one-time expenses, and revenue patterns. These insights will help you forecast more accurately and create a budget that reflects your business’s real-world financial behavior.

Understanding your expenses is critical to building a realistic and flexible budget. Start by categorizing your costs into two groups: fixed and variable. This helps you determine which expenses are predictable and which may change based on business activity.

Fixed costs remain consistent from month to month, regardless of sales volume. These provide a stable foundation for budgeting:

Variable costs fluctuate depending on production levels, customer demand, or other business activity:

Separating these categories makes it easier to forecast expenses, manage cash flow, and adjust spending when needed. It also helps you identify areas where cost-cutting is possible without impacting core operations.

Once you understand your cost structure, the next step is to estimate how much income your company expects to generate. A revenue forecast is a forward-looking projection based on past performance, current market conditions, and planned business activities. It sets the upper boundary for how much you can realistically spend.

Start by reviewing your historical revenue data and adjusting for any known changes in operations, pricing, or demand. Then factor in any growth initiatives, such as product launches or marketing campaigns, that could affect future sales.

Key inputs for forecasting revenue include:

It’s important to remain realistic. Overestimating revenue can result in overspending, while underestimating may cause you to miss opportunities. If you’re uncertain, consider creating multiple forecast scenarios—baseline, conservative, and optimistic—to help plan for different outcomes.

With your revenue forecast and cost breakdown in place, the next step is to decide how funds will be distributed across the company. Resource allocation is about connecting your budget to your business goals. It ensures that each department or initiative has the funding it needs to operate effectively and support growth.

Start by mapping expenses to your core objectives. For example, if expanding your customer base is a top priority, you may need to allocate more toward marketing and sales. If operational efficiency is the focus, you might invest more in systems or personnel.

Common categories for budget allocation include:

Be prepared to make trade-offs. Not every area will receive equal funding, and that’s okay. The goal is to align spending with impact. By prioritizing where your dollars go, you create a budget that supports business outcomes rather than simply tracking expenses.

No matter how well you plan, unexpected expenses and market shifts are a normal part of running a business. Including a contingency buffer in your budget helps you absorb surprises without derailing your operations or growth plans.

A contingency fund acts as a financial cushion. It can be used for emergency repairs, sudden drops in revenue, supply chain disruptions, or other unplanned costs. Setting aside even a small percentage of your total budget can make a big difference when the unexpected happens.

Here are a few ways to structure contingency planning:

Building flexibility into your budget isn’t a sign of uncertainty—it’s a sign of preparation. It allows your team to stay focused and respond quickly when plans change.

A budget isn’t a one-time exercise. To be effective, it needs to be monitored and updated regularly. Business conditions change, goals evolve, and unexpected challenges can arise throughout the year. Reviewing your budget on a monthly or quarterly basis helps ensure your spending stays aligned with actual performance.

Start by comparing your projected numbers against real results. Look for variances in revenue, expenses, or cash flow, and investigate why those differences occurred. Some adjustments may be minor, like reallocating funds between departments. Others may require rethinking parts of your budget if performance falls short or priorities shift.

Key things to track during regular reviews:

Use these reviews as an opportunity to refocus your efforts, catch problems early, and make more informed decisions. A flexible budget, backed by regular oversight, gives your company a better chance to stay agile and financially healthy over time.

Mar 05, 2024

5 min read

Starting and growing a business requires immense working capital reserves, and...

Read story

Jun 28, 2022

2 min read

One of the biggest misconceptions about business financing is that it’s...

Read story

Jun 13, 2022

2 min read

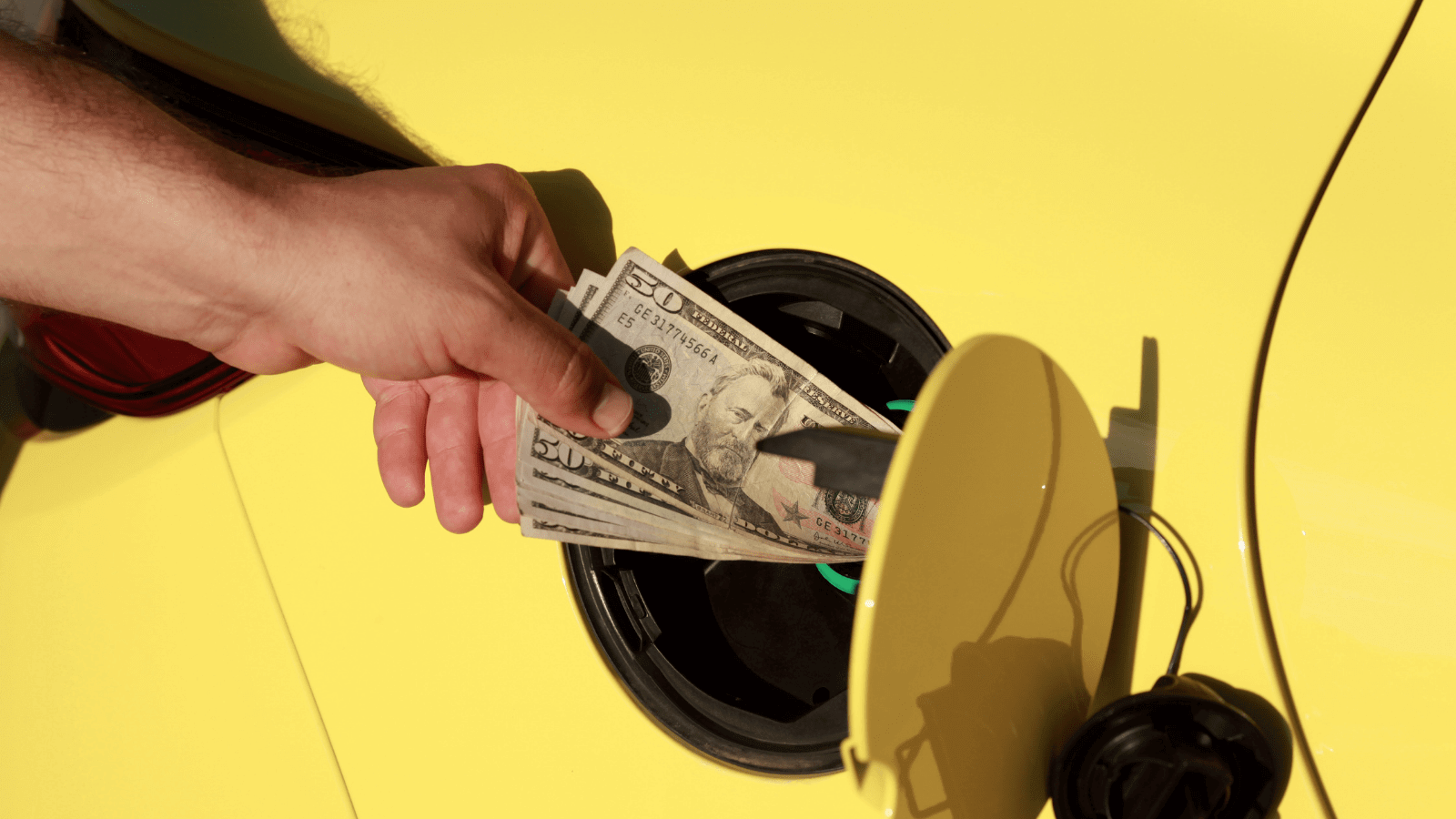

With gas prices soaring to record highs, small businesses are feeling...

Read story

A funding specialist will get back to you soon.

If you can’t hang on then give us a call at (844) 284-2725 or complete your working capital application here.