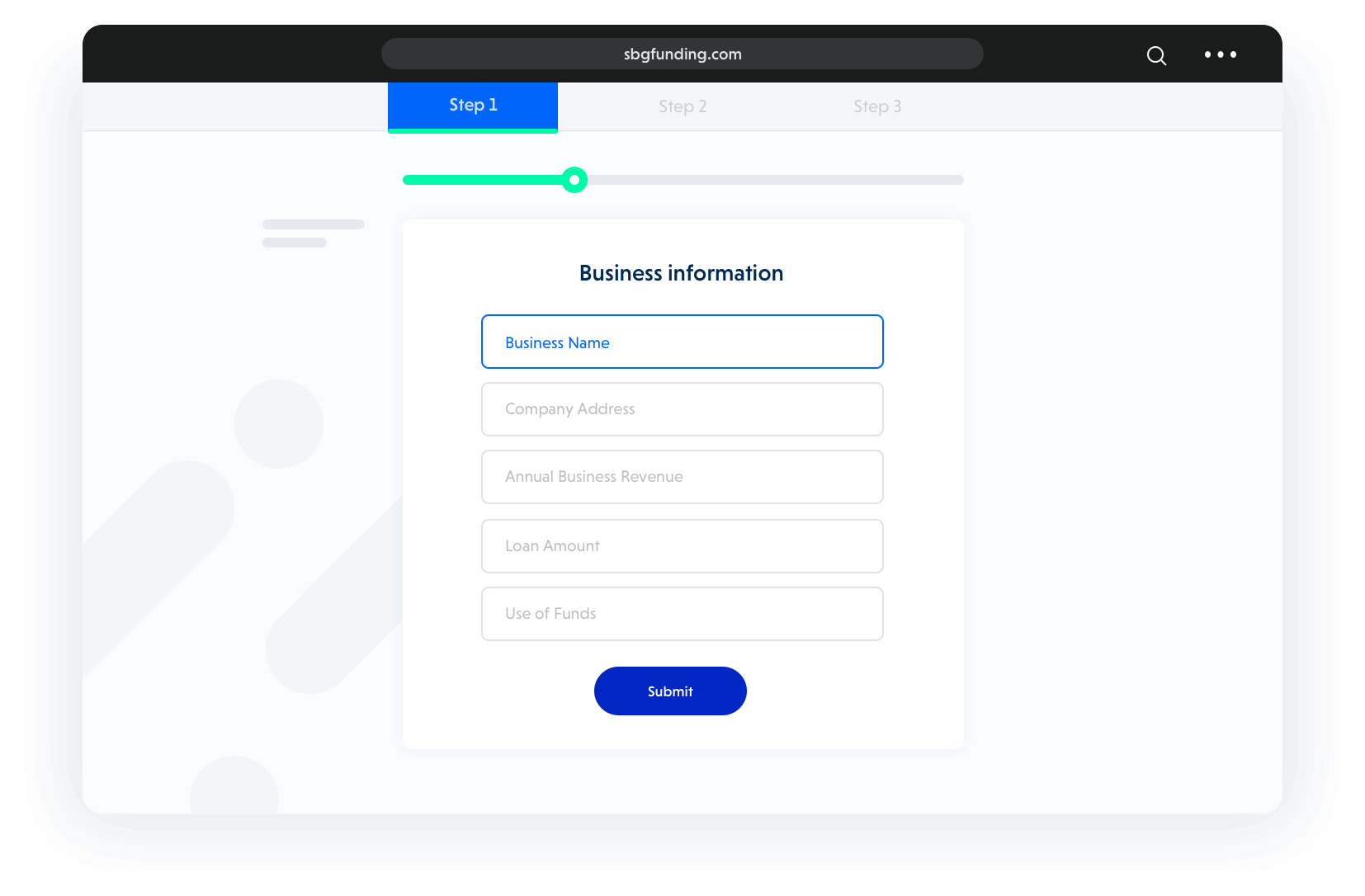

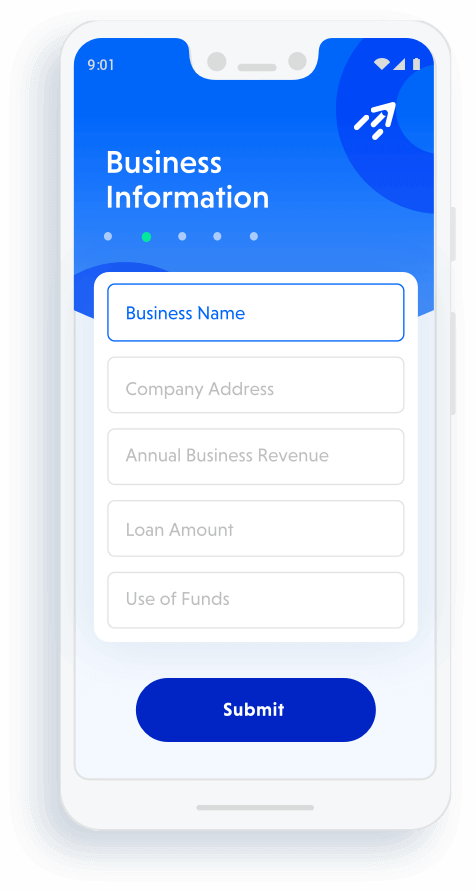

Just 3 steps to get this funding started!

At SBG we keep the application process simple so you can focus on meeting your business needs, from keeping payroll covered to purchasing more inventory in busy seasons.

Apply Online

Just a few quick questions and away we go

Get Approved

Get your approval and jump for joy!

Receive Your Funds

Accept your terms and the funds are on the way!