Jun 18, 2025

5 min read

What Is a Personal Guarantee for a Business Loan?

A personal guarantee is a legally binding promise made by a...

Read story

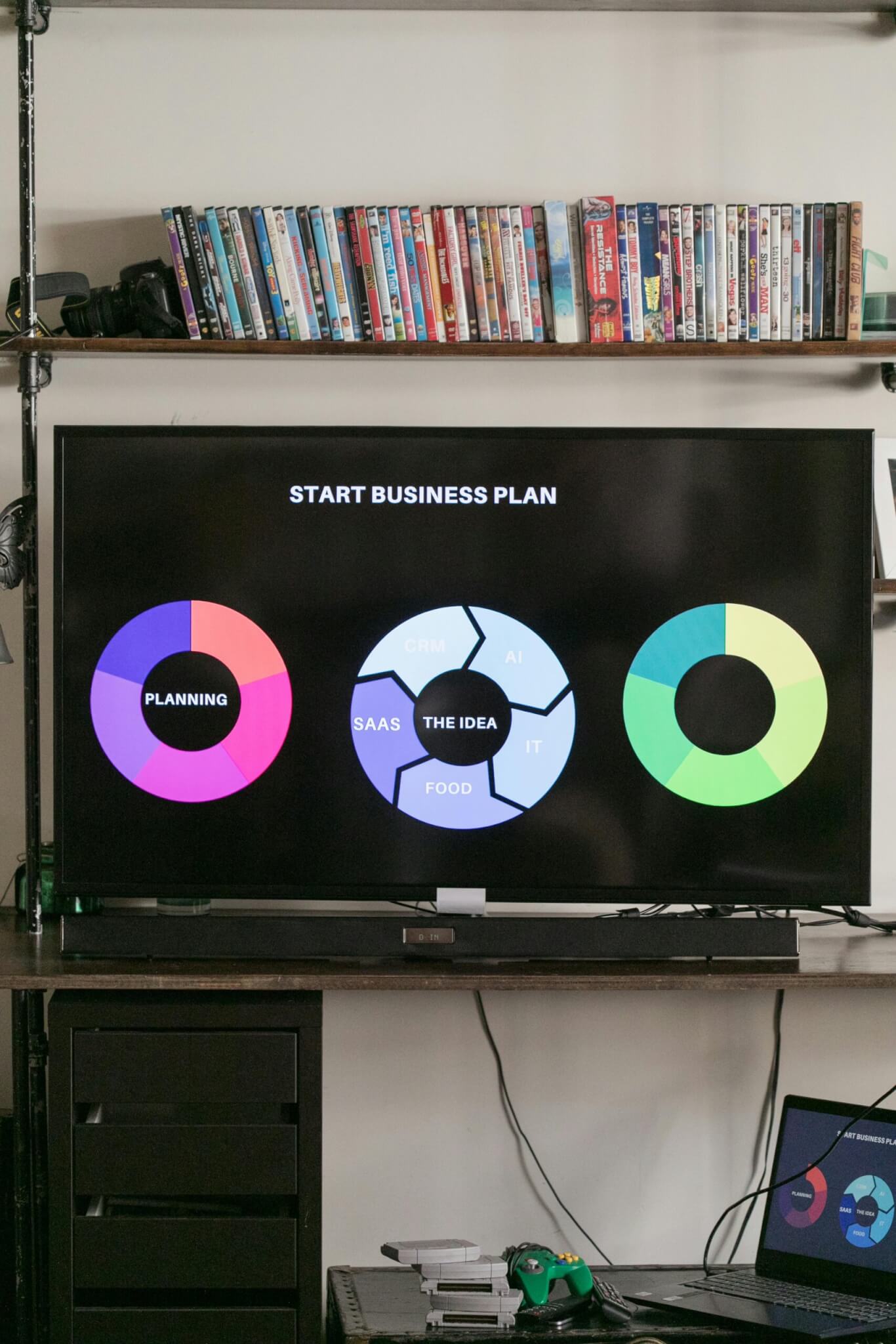

Navigating tax obligations is crucial for small business success. Effective tax planning can enhance financial health, reduce liabilities, and support long-term growth. By staying informed and proactive, small business owners can make strategic decisions that align with their goals and ensure compliance with evolving regulations.

This article offers essential tax tips to help small business owners optimize their tax strategies, streamline preparation, and position their businesses for sustainable financial success.

Accurate record keeping is essential for tax compliance and informed decision-making. Organize financial documents like invoices, receipts, and bank statements, and update records regularly to avoid last-minute issues. Digital copies can reduce clutter and provide backup options.

Set up an intuitive filing system with consistent naming conventions for easy access. Using accounting software like QuickBooks can automate record-keeping, categorize transactions, and generate financial reports, simplifying tax preparation.

Keep records for at least three years, or longer if needed, to comply with IRS guidelines and be prepared for potential audits. Prioritizing record keeping supports smoother tax preparation and strategic growth.

Understanding tax deductions helps reduce your tax liability and manage your business finances more effectively. Deductible expenses often include office supplies, travel costs, and employee salaries. Maintain thorough records and receipts to substantiate claims in case of an audit.

Distinguish between regular deductible expenses and capital expenses, like equipment or property, which are depreciated over time. Knowing this difference allows you to plan finances and maximize deductions across years.

Stay informed of tax law changes to optimize deductions, and consider consulting a tax professional for tailored advice. Leveraging deductions strategically can enhance financial health and compliance.

Leveraging tax credits can significantly reduce your tax liability and allow you to reinvest savings into your business. Unlike deductions, which lower taxable income, tax credits provide a dollar-for-dollar reduction in the actual tax owed, directly impacting your bottom line.

Several tax credits are particularly beneficial for small businesses:

To effectively leverage these credits:

By understanding and utilizing tax credits effectively, you can reduce your tax burden, allowing you to allocate more resources toward growth and development. Stay informed of changes in tax laws to take full advantage of available credits.

Estimated tax payments are essential for small business owners without taxes withheld from their income, such as sole proprietors, partners, and S corporation shareholders. The IRS requires taxes to be paid as income is earned, making these quarterly payments necessary.

To determine if you need to make estimated tax payments, check if you expect to owe at least $1,000 after subtracting withholding and refundable credits. If your withholding and credits are less than 90% of the current year’s tax or 100% of the prior year’s tax, you should consider making estimated payments.

Here’s how to manage estimated tax payments:

Consulting a tax professional can provide personalized insights, especially if your income varies. Accounting software can also automate calculations and reminders to ensure you meet all deadlines.

Staying proactive with estimated tax payments helps you avoid penalties and maintain cash flow throughout the year.

Maintaining a clear boundary between business and personal expenses is essential for financial clarity and smoother tax preparation. Mixing these expenses can lead to confusion, inaccurate records, and potential IRS scrutiny, as personal expenses are not deductible for business purposes under IRS regulations.

Start by opening dedicated business bank accounts and credit cards to track transactions effectively. Taking these financial steps, especially when starting a business, make tracking expenses simpler and improve compliance with IRS requirements. Using accounting software or spreadsheets can help you record and categorize expenses regularly. Keeping digital copies of receipts ensures easy access and compliance with IRS documentation requirements.

Pay yourself a salary or take an owner’s draw to maintain a clear separation between personal and business finances. If using business funds for personal purposes, document these as draws or loans and keep accurate records. Establishing a budget that differentiates business expenses from personal ones helps prevent unintentional mixing.

Adhering to these practices aligns with IRS recommendations and supports accurate tax filings, reducing the risk of issues during audits and facilitating smoother tax preparation.

Using accounting software can streamline tax preparation and improve financial organization for small businesses. These tools help maintain accurate records, automate tasks, and minimize errors, saving time and effort.

Accounting software automatically categorizes income and expenses, making tax season preparation easier by ensuring all transactions are recorded consistently. Many programs also offer invoicing, payroll management, and inventory tracking for more comprehensive business operations.

To maximize benefits:

Consulting a tax professional ensures your business taxes are managed efficiently and accurately. These experts have up-to-date knowledge of tax laws and provide tailored guidance, helping you navigate complex regulations and potentially save time and money.

A tax professional can identify deductions and credits you might overlook, assist with tax filing to minimize errors, and reduce the risk of audits. They also offer strategic advice for future tax planning, helping align business goals with tax efficiency.

When choosing a tax professional:

The cost of hiring a tax professional can be offset by the long-term benefits of optimized tax strategies and avoiding costly mistakes.

Contributing to retirement plans is a strategic approach for small business owners to reduce taxable income while securing future financial stability. By allocating funds to qualified retirement accounts, you can lower your current tax liability and invest in your long-term financial health.

Popular Retirement Plans:

Maximizing Benefits:

By strategically planning and contributing to retirement accounts, you can effectively reduce your tax liabilities while building a secure financial future.

Staying aware of tax deadlines is essential for compliance and avoiding penalties. Familiarize yourself with federal and state due dates, including income tax returns, payroll taxes, and quarterly estimated tax payments, typically due on April 15, June 15, September 15, and January 15.

Create a comprehensive tax deadline checklist that includes federal, state, and local obligations. Regularly update and review it to ensure no dates are missed. Utilize calendar apps or accounting software with reminders for added security and peace of mind.

Proactively managing tax deadlines helps your business avoid penalties and ensures smoother financial operations.

The home office deduction allows eligible small business owners to deduct expenses related to the business use of their home, potentially reducing taxable income. To qualify, the workspace must be used exclusively and regularly for business purposes.

There are two methods to calculate this deduction:

Ensure your home office meets IRS criteria, and maintain records to support your claim. Consulting a tax professional can help determine the most beneficial method for your situation. Claiming this deduction can reduce your taxable income, freeing up funds for business reinvestment.

Charitable contributions can be a strategic way for small businesses to support their communities and reduce taxable income. To maximize the tax benefits of your donations:

By thoughtfully managing charitable contributions, your business can take advantage of valuable tax deductions while making a positive community impact.

Jun 18, 2025

5 min read

A personal guarantee is a legally binding promise made by a...

Read story

Jun 12, 2025

3 min read

Running a business means understanding your numbers. One of the most...

Read story

Jun 09, 2025

5 min read

Starting a business requires careful planning, and one of the most...

Read story

A funding specialist will get back to you soon.

If you can’t hang on then give us a call at (844) 284-2725 or complete your working capital application here.