11 Tips to Improve Cash Flow for Your Business

Effective cash flow management is critical for businesses to maintain operations, capitalize on growth opportunities, and stay resilient during financial challenges. Cash flow is more than just tracking money in and out—it involves using strategies to accelerate receivables, manage payables, and streamline operations to ensure liquidity at every stage.

Understanding how to optimize cash flow helps businesses reduce financial risks, maintain flexibility, and invest in long-term growth. In this guide, we’ll explore practical strategies that combine technology, automation, and proactive management to enhance cash flow and strengthen financial stability.

Monitor Cash Flow Regularly

Consistent cash flow monitoring helps businesses stay ahead of financial issues, identify trends early, and make proactive decisions to maintain stability. In today’s competitive environment, businesses must go beyond tracking cash flow—they should leverage technology to gain deeper insights into their financial position.

- Set a Review Schedule: Monitor cash flow weekly, bi-weekly, or monthly, depending on business needs and cash flow complexity. For companies with frequent transactions, a weekly review may be necessary, while service-based businesses may find monthly reviews sufficient.

- Use Cash Flow Statements Effectively: Understand key components—operating, investing, and financing activities—to track where money flows in and out. Understanding these activities helps businesses know where their cash is going and if they are financing operations sustainably or relying too heavily on external funding.

- Leverage Data Analytics Tools: AI-powered platforms now provide real-time insights into cash flow trends, helping businesses forecast shortfalls and detect patterns early to avoid disruptions. As highlighted by Forbes, integrating AI into financial management improves visibility, enabling proactive decisions to mitigate risks.

- Incorporate Forecasting Software: Use tools like QuickBooks or Xero to integrate real-time data and improve cash flow projections. These tools can also model various financial scenarios, helping businesses plan for best- and worst-case outcomes, and adjust their strategies in real-time based on shifting economic conditions.

- Focus on Key Drivers: Identify significant inflows and outflows, such as seasonal revenues or operational costs, and develop strategies to manage them proactively. Early identification of these trends allows for better planning, such as preparing for lean periods or reinvesting in business growth during revenue peaks.

With effective cash flow monitoring, businesses can confidently plan for growth, minimize risks, and maintain financial flexibility through fluctuating market conditions.

Optimize Inventory Management

Efficient inventory management reduces costs, improves cash flow, and ensures resources aren’t tied up in unsold stock. Businesses need to balance having enough inventory to meet demand without overstocking and wasting capital.

- Conduct an Inventory Audit: Identify sales patterns and align stock levels with customer demand to avoid holding excess inventory. Regular audits ensure businesses can respond to shifting market conditions, reduce shrinkage, and prevent over-purchasing. This approach improves not only operational efficiency but also customer satisfaction by maintaining the right products in stock at the right time.

- Use Inventory Management Software: Tools like Zoho Inventory (great for small businesses and startups), Katana (ideal for manufacturing companies), and Square Inventory (suitable for retail shops) streamline tracking, reduce manual errors, and ensure real-time visibility. These platforms also integrate with popular accounting systems like QuickBooks and Xero, making it easier to sync financial and operational data.

- Adopt Just-in-Time (JIT) Inventory: Order only what’s needed to lower storage costs, but ensure suppliers can meet tight delivery schedules. While JIT reduces holding costs, it also requires a highly reliable supply chain to avoid stockouts that could disrupt operations.

- Apply ABC Analysis: Focus on high-value, low-frequency items while avoiding overstock of low-value products. ABC analysis categorizes stock based on value and turnover rates, helping businesses prioritize their attention on the most critical products. For example, “A” items—high-value, low-quantity—should always be closely monitored to avoid shortages.

- Spread Orders Across Time: Work with suppliers to spread deliveries into smaller, more frequent batches to improve cash flow. This approach reduces the need to hold large amounts of stock and minimizes upfront payment commitments, allowing businesses to maintain liquidity more effectively.

- Liquidate Obsolete Stock: Use discounts or promotions to free up capital tied in unsold inventory. Deadstock clearance campaigns not only improve cash flow but also create opportunities to attract customers with special offers. Businesses can also explore partnerships with liquidation services to offload inventory more efficiently.

Optimizing inventory management ensures businesses maintain healthy liquidity, lower operational costs, and remain responsive to market demands.

Extend Payables Period

Extending the payables period allows businesses to retain cash longer, improving liquidity without additional borrowing. This strategy requires balancing payment schedules with maintaining strong supplier relationships.

- Review Payment Terms: Identify suppliers willing to offer more favorable terms based on your purchase volume and payment history. For example, reliable customers may qualify for 45- or 60-day terms instead of the standard 30 days.

- Negotiate Smaller, Spread-Out Payments: Breaking down large orders into smaller, staggered deliveries reduces the immediate financial burden, easing cash flow constraints over time. This is particularly useful for businesses with fluctuating seasonal demand.

- Form Buying Cooperatives: Collaborate with other businesses to purchase in bulk and unlock better pricing or discounts. In industries like retail or food service, these cooperatives enhance small businesses’ competitive edge by providing leverage in negotiations with suppliers.

- Use Electronic Payment Systems: Automate payments to avoid late fees while scheduling them for the latest allowable date. This ensures cash stays in your accounts longer, improving liquidity without disrupting vendor relationships.

By strategically managing payables, businesses can free up working capital while maintaining trust and flexibility with suppliers.

Accelerate Receivables

Speeding up receivables is crucial for maintaining liquidity and ensuring businesses can meet operational needs. Optimizing invoicing and payment processes encourages timely payments and reduces delays.

- Send Invoices Immediately: Issue invoices right after delivering goods or services to reduce processing delays. Prompt invoicing creates urgency, signaling professionalism and encouraging faster payments.

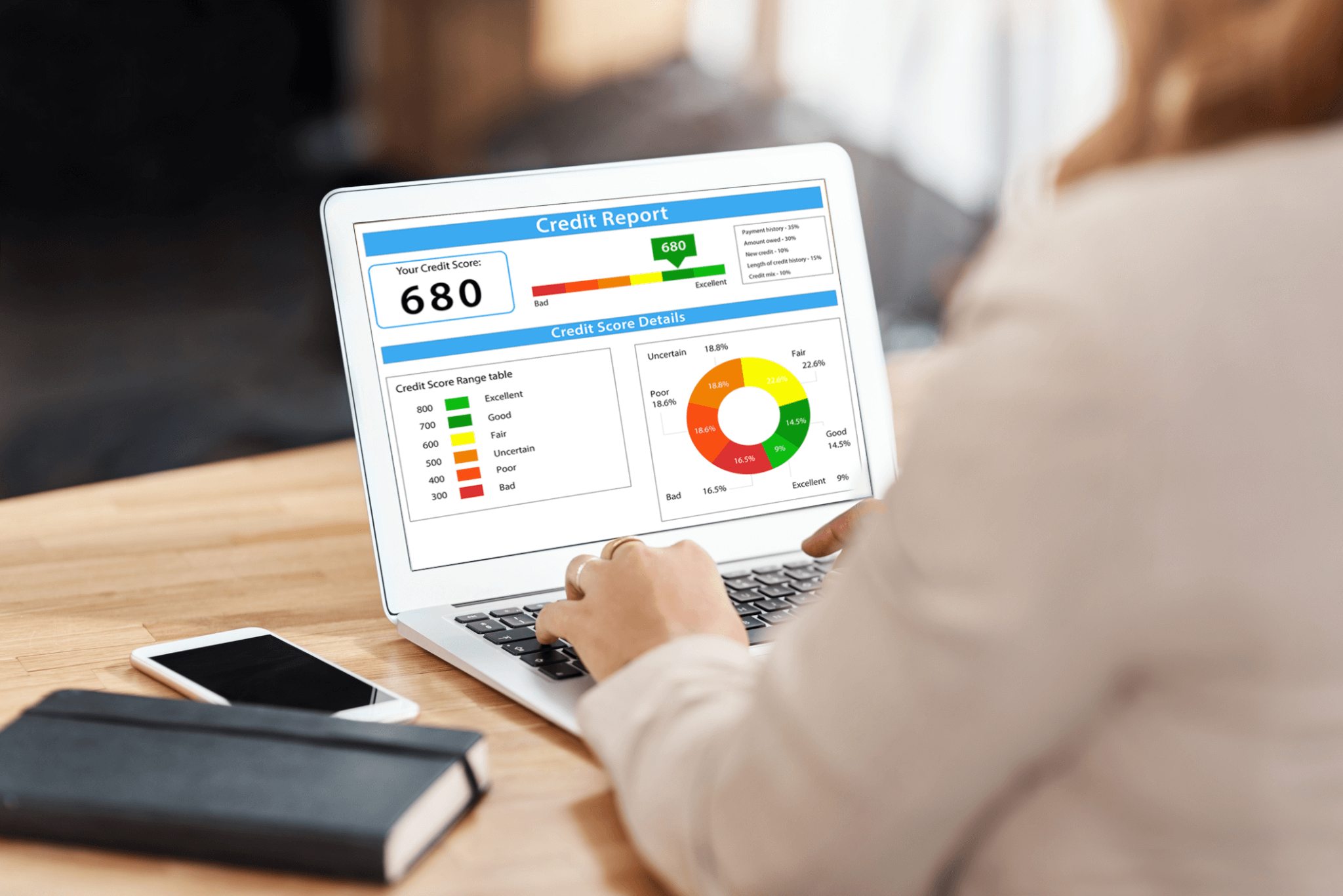

- Perform Customer Credit Checks: Check credit histories before offering credit to minimize payment risks. Platforms like Dun & Bradstreet or Equifax help businesses assess the creditworthiness of new clients to avoid risky payment terms.

- Offer Multiple Payment Options: Providing multiple payment methods, such as ACH transfers, PayPal, or credit cards, makes it easier for customers to pay on time. Offering diverse payment choices not only accommodates preferences but also speeds up collections. According to Banked, businesses that offer at least three payment methods see payments processed approximately 30% faster than those with limited options.

- Introduce Penalties for Late Payments: Apply late fees to encourage on-time payments. Clear communication about penalties can incentivize customers to settle invoices promptly, protecting your cash flow.

- Set Up Automatic Billing: Automate recurring payments for subscription-based services or long-term clients to eliminate missed deadlines. Automated systems also reduce manual workload and improve consistency in collections.

- Monitor Days Sales Outstanding (DSO): Track how quickly invoices are collected and adjust strategies as needed. High DSO rates could signal issues in collections or indicate the need to renegotiate credit terms with customers. Regular monitoring helps fine-tune strategies and ensures smoother cash flow.

By streamlining receivables and encouraging fast payments, businesses can maintain healthy cash flow and reduce reliance on short-term financing.

Implement Cash Flow Forecasting

Cash flow forecasting helps businesses predict future cash needs, prepare for shortfalls, and plan investments. This proactive strategy ensures that businesses stay financially agile.

- Analyze Historical Data: Evaluate past cash flow patterns to identify trends, seasonality, and irregularities, helping predict future inflows and outflows more accurately. Historical insights provide a foundation for informed forecasts.

- Incorporate Forecasting Software: Utilize tools like QuickBooks or Xero to streamline forecasting through real-time data integration, ensuring projections reflect the latest financial movements. These tools automate calculations, reducing human error and saving time for finance teams.

- Use Scenario Planning: Develop multiple forecasts based on different market conditions—such as a sudden drop in revenue or an unexpected surge in demand—to prepare for both best- and worst-case outcomes. Scenario planning helps identify cash flow gaps early, allowing businesses to act swiftly.

- Engage Key Stakeholders: Collaborate with department heads to create comprehensive forecasts that align with the company’s operational goals. Involving cross-functional teams ensures forecasts reflect all aspects of the business, from production schedules to marketing campaigns.

- Update Forecasts Regularly: Adjust forecasts as conditions evolve to stay aligned with strategic cash flow goals. Frequent updates—weekly, monthly, or quarterly—ensure the business remains responsive to internal and external changes, such as new regulations, interest rate shifts, or supplier disruptions.

By forecasting cash flow effectively, businesses can anticipate challenges, seize opportunities, and maintain financial stability.

Reduce Overhead Costs

Lowering overhead costs improves cash flow by freeing up resources for essential business activities. Strategic cost-cutting combined with technology can boost efficiency without sacrificing quality.

- Conduct a Cost Audit: Identify unnecessary expenses, such as unused subscriptions or redundant services, and eliminate them. Regular audits also help spot overlooked recurring charges.

- Adopt Remote or Hybrid Work Models: According to recent findings, 73% of companies plan to reduce their office space in 2024, driven by the rise of hybrid and remote work. Downsizing office space not only saves rent and utilities but also redirects those savings toward growth initiatives or operational improvements, enhancing business resilience.

- Leverage Automation and AI: Automate routine tasks like payroll, invoicing, and customer service to minimize labor costs and improve accuracy. Automation tools also allow employees to focus on higher-value tasks, further increasing productivity.

- Outsource Non-Core Functions: Hire specialized contractors or agencies for non-core activities, such as IT support, marketing, or HR services. This reduces the overhead of maintaining full-time staff while ensuring high-quality outcomes.

- Implement Energy-Saving Measures: Utilize energy-efficient lighting and smart thermostats to lower utility expenses. Incentives or rebates may be available for businesses investing in green technology, further boosting savings.

- Encourage Employee Involvement: Engage employees in cost-saving efforts by inviting suggestions on streamlining processes. Empowering staff to identify inefficiencies helps build a culture of cost-consciousness.

By integrating automation with strategic cost management, businesses can reduce overhead and maintain healthy cash flow while staying competitive.

Negotiate Better Terms with Suppliers

Negotiating favorable terms helps businesses manage cash flow more effectively by delaying payments or securing discounts. Building strong supplier relationships is essential for maintaining flexibility during cash flow challenges.

- Review Existing Agreements: Analyze current supplier contracts to identify partners who might offer extended payment terms or volume-based discounts. Regular reviews ensure businesses don’t miss out on updated or more favorable terms.

- Form Buying Cooperatives: Collaborate with other businesses in the same industry to pool purchases. This collective buying power can unlock bulk discounts and better pricing, enhancing your leverage in negotiations—especially in industries like retail, manufacturing, or food services.

- Focus on Partnership Building: Frame negotiations as a long-term collaboration. Highlight your reliability as a customer by emphasizing on-time payments and consistent order volumes. Strong partnerships encourage suppliers to offer more favorable terms.

- Propose Early Payments for Discounts: Offer early payments in exchange for discounts to reduce total costs. This strategy benefits suppliers by improving their cash flow, creating a win-win situation.

- Document New Agreements: Clearly document negotiated terms in contracts to prevent misunderstandings. Align payment schedules with cash flow cycles to avoid future disruptions.

By balancing strategic negotiations with supplier relationships, businesses can reduce cash outflows, improve their financial flexibility, and foster mutually beneficial partnerships. These efforts ultimately create more room for growth and stability, especially during challenging financial periods.

Offer Discounts for Early Payments

Offering discounts for early payments encourages faster invoice settlements, improving cash flow and reducing the need for credit.

- Determine a Sustainable Discount: Use structures like 2/10 net 30—offering a 2% discount if paid within 10 days of a 30-day term. Analyze your profit margins to ensure the discount makes financial sense. While this incentive can accelerate cash flow, ensure it doesn’t erode profitability, especially for lower-margin goods.

- Clearly Communicate Terms: Specify the discount amount, eligibility, and deadlines directly on invoices to avoid confusion. Clarity ensures customers know the benefits of paying early, improving adoption rates.

- Track Customer Responsiveness: Use payment analytics to monitor how frequently customers take advantage of the discount. Adjust the program based on customer behavior and trends. If certain clients don’t use the discount, consider alternative incentives or renegotiate terms.

- Align Discounts with Financial Strategy: Focus early payment discounts where they will have the most impact, such as with customers who have historically paid late. Using these payments to reduce reliance on short-term credit can strengthen your working capital and reduce financing costs.

- Evaluate Impact on Profit Margins: Regularly review how the discount affects overall profitability, especially for high-volume customers. Discounts may be more valuable for large orders, but careful analysis ensures they remain beneficial without cutting too deeply into margins.

When used thoughtfully, early payment discounts foster customer goodwill while ensuring consistent cash flow for the business.

Lease Equipment Instead of Buying

Leasing equipment helps businesses conserve cash by spreading costs over time, improving liquidity without the upfront expense of buying. It also offers strategic flexibility, especially in industries where technology or equipment rapidly evolves.

- Preserve Cash Flow: Leasing allows businesses to pay smaller installments over time, freeing up cash for other operational needs or investments. This is particularly valuable for startups or businesses with fluctuating cash flows, as they can access equipment without large upfront payments.

- Gain Tax Benefits: Lease payments are typically considered business expenses and are tax-deductible, offering savings over time. Consult a tax professional to ensure your business maximizes these deductions under the latest tax codes.

- Stay Flexible with Upgrades: Leasing ensures that businesses can access the latest technology or equipment as it becomes available. This flexibility prevents companies from being locked into outdated machinery and allows upgrades as operational needs evolve.

- Reduce Maintenance Burden: Many lease agreements bundle in maintenance services, reducing the risk of unexpected repair costs and downtime. This feature ensures predictable expenses and minimizes disruptions to operations.

- Align Payments with Cash Flow: Seasonal businesses benefit from leasing by scheduling payments to align with periods of higher revenue. This approach prevents cash flow constraints during slower months and ensures smoother financial management.

In industries such as construction, manufacturing, and healthcare, leasing equipment is increasingly becoming a preferred strategy to maintain competitiveness and operational efficiency without the financial strain of ownership. Businesses can also explore lease-to-own options if they anticipate long-term use but prefer to start with manageable payments.

Increase Sales through Upselling and Cross-Selling

Upselling and cross-selling enhance cash flow by increasing revenue from existing customers, reducing the need for new acquisitions.

- Understand Customer Needs: Leverage customer data, such as purchase history and behavioral trends, to tailor offers that align with preferences. Tools like Amazon’s recommendation engine demonstrate how analyzing purchase patterns can increase upsell success rates.

- Offer Genuine Value: Focus on products or services that meaningfully enhance the customer’s experience. For instance, a customer purchasing software may benefit from a premium support package, adding value while increasing revenue.

- Time Offers Strategically: Present upsell and cross-sell opportunities during key customer touchpoints, such as at checkout or through follow-up emails. Statistics show that post-purchase emails generate higher conversion rates, making them an ideal avenue for cross-selling complementary products.

- Use Technology for Personalization: Leverage AI-powered tools like HubSpot CRM (ideal for marketing automation and customer insights), Zoho’s Zia AI (which offers predictive sales analytics), and Freshsales’ Freddy AI (providing deal insights and lead scoring). These tools enable businesses to tailor recommendations, automate outreach, and identify high-potential sales opportunities.

- Train Your Team: Equip staff with the knowledge and skills to identify sales opportunities and offer relevant products seamlessly. Providing incentives to your team for successful sales also motivates proactive selling behaviors.

By focusing on personalization, strategic timing, and value, businesses can foster deeper customer relationships, drive additional revenue, and improve cash flow. When implemented consistently, upselling and cross-selling reduce reliance on new customer acquisition while enhancing customer satisfaction and loyalty.

Manage Tax Obligations Effectively

Proactively managing taxes prevents cash flow disruptions and helps businesses stay financially healthy throughout the year.

- Maintain Accurate Records: Use accounting software like QuickBooks (widely known for its tax reporting and inventory management), FreshBooks (ideal for service-based businesses with time-tracking needs), or Wave Accounting (a free solution for tracking income and expenses). Use accounting software like QuickBooks (widely known for its tax reporting and inventory management), FreshBooks (ideal for service-based businesses with time-tracking needs), or Wave Accounting (a free solution for tracking income and expenses). These tools automate processes such as bank reconciliations, expense tracking, and invoice generation, making tax filing easier and reducing human error.

- Stay Updated on Tax Regulations: Tax laws can change frequently. Keep track of both federal and state-level changes to ensure compliance and uncover new deductions or credits. Some businesses benefit from industry-specific incentives, such as tax credits for green initiatives or research and development (R&D).

- Plan for Taxes Year-Round: Instead of scrambling for funds at the end of the fiscal year, set aside a portion of revenue regularly to cover estimated taxes. This approach prevents cash flow shortages and aligns with quarterly filing requirements. Businesses can also use automated reminders for estimated payment deadlines to stay on track.

- Implement a Tax Calendar: Use a tax calendar to monitor critical filing and payment deadlines for payroll, sales, and income taxes. Many accounting platforms include automated reminders to help businesses meet these deadlines and avoid late fees or penalties.

- Explore Tax Incentives: Research available tax credits and incentives applicable to your industry, such as R&D credits, energy efficiency grants, or pandemic-related relief programs. Proper use of incentives reduces your tax burden and frees up cash for reinvestment.

- Consult with a Tax Professional: Working with a certified accountant or tax advisor ensures compliance with the latest regulations and helps optimize your tax strategy. Professionals can identify deductions or credits that software alone might miss and provide guidance for tax-efficient financial planning.

By managing taxes proactively, businesses can avoid financial surprises, maintain cash flow stability, and reduce stress during tax season. A forward-thinking tax strategy also unlocks opportunities to reinvest savings back into growth initiatives.

Enhance Your Cash Flow with SBG Funding

Proactively managing cash flow is key to staying competitive and seizing growth opportunities. By implementing strategies such as optimizing inventory, streamlining operations, and negotiating better terms with suppliers, businesses can improve liquidity and reduce financial risks.

When you need additional support to manage your cash flow effectively, SBG Funding is here to help. We offer flexible financing solutions, including working capital loans, lines of credit, and invoice financing, designed to meet your business’s unique needs. Ready to take the next step? Apply now and keep your business moving forward with the right financial resources.